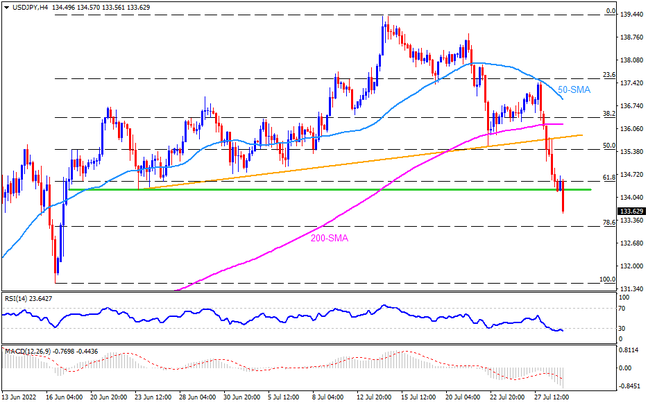

USDJPY broke a five-week-old support line, as well as a horizontal area around 134.25 that comprises the levels marked since June 17, to refresh the monthly low near 133.75. It’s worth noting, however, that oversold RSI conditions challenge the bears ahead of the US PCE Price Index for July, the Fed’s preferred inflation data. However, the corrective pullback needs validation from the immediate horizontal support-turned-resistance around 134.20, as well as the ascending trend line from June 23, near 135.75, to recall the buyers. Even so, the 200-SMA near 136.20 will test the upside momentum.

On the contrary, the pair’s further downside aims at the 78.6% Fibonacci retracement of the June-July upside, around 133.15. Following that, the 131.50-25 area comprising mid-June lows and highs marked in April, as well as in May, will be a tough nut to crack for the pair bears. It’s worth noting that the pair’s sustained declines past 131.25 could make it vulnerable to revisiting May’s low around 126.35.

Overall, USDJPY recently broke the crucial support but the odds favoring further downside are fewer.

Join us on FB and Twitter to stay updated on the latest market events.