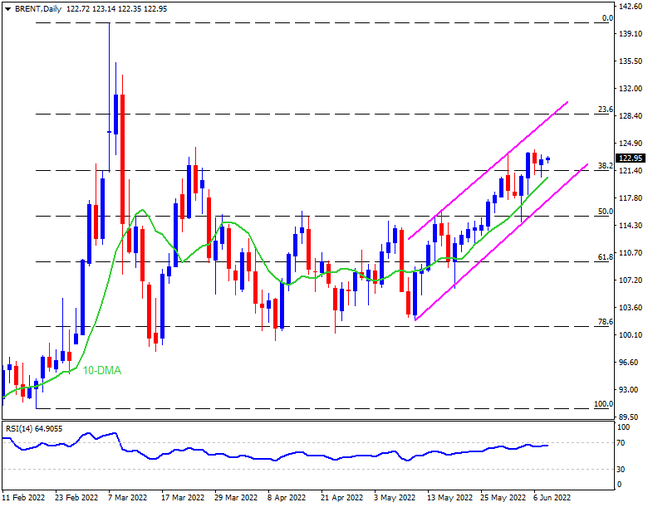

Brent oil prices grind higher around late March tops, staying above 10-DMA inside a monthly bullish channel formation. Given the firmer RSI backing the black gold’s gradual north-run, the quote is likely to overcome the immediate hurdle, namely the late March swing high around $124.40. However, the stated channel’s upper line near $127.50, which if ignored could propel the energy benchmark towards the yearly high marked in March at around $140.50. During the run-up, then likely overbought RSI may interrupt the upside momentum around $130.00 and the $135.00 intermediate halts.

Meanwhile, pullback moves may remain elusive until staying beyond the 10-DMA level surrounding $119.60. Following that, the support line of the bullish channel, close to $117.00 by the press time, will be crucial to watch. In a case where Brent oil sellers manage to conquer the $117.00 support and reject the bullish formation, there are multiple supports around $115.50 and $115.000 before directing the quote towards May’s low near $101.90.

Overall, oil prices remain firmer inside a bullish chart pattern and are likely to rise further. However, the upside momentum will be shaky and hence needs the trader’s discretion.

Join us on FB and Twitter to stay updated on the latest market events.