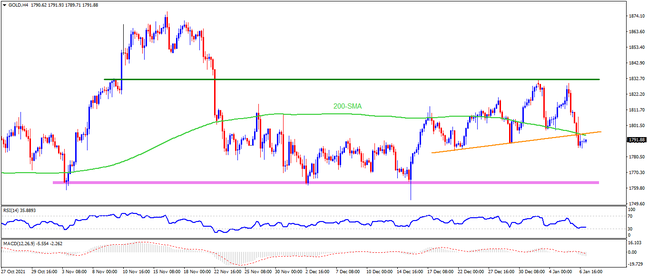

Having reversed from early November’s swing high, gold broke the key support around $1,795 comprising 200-SMA and a 13-day-old ascending trend line. The downside move gains support from bearish MACD signal to direct gold bears towards a two-month-old horizontal region surrounding $1,760. However, RSI does approach the oversold territory and can trigger intermediate bounces off $1,780. It’s worth noting that gold’s selling past $1,760 won’t hesitate to refresh December lows around $1,751.

Alternatively, a corrective pullback beyond $1,795, will need validation from the $1,800 threshold to rise further. Further, $1,820 and the monthly peak surrounding $1,832 can test the bulls. Additionally, tops marked in July and September 2021 near $1,834 will precede the $1,850 round figure to challenge the metal’s further upside ahead of pushing bulls towards November’s peak of $1,877. Overall, gold sellers have sneaked in before the key US data but it all depends upon how well the US Nonfarm Payrolls (NFP) justify hawkish hopes raised by FOMC Minutes.

Join us on FB and Twitter to stay updated on the latest market events.