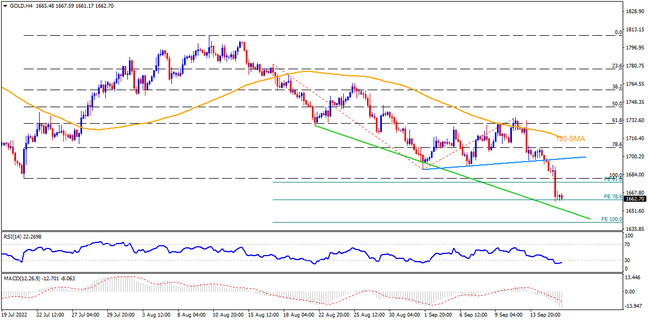

Gold renewed the yearly bottom on breaking the fortnight-old support line, now resistance around $1,700, the previous day. The following consolidation, however, remains doubtful even as the oversold RSI challenges intraday sellers. That said, the precious metal drops towards the 78.6% Fibonacci Expansion (FE) of the August 17 to September 12 moves, near $1,662. Though, a three-week-long downward sloping support line from late August, near $1,650, could trigger the quote’s rebound, if not then the 100% FE level surrounding $1,641 and the $1,600 threshold will be in focus.

Alternatively, recovery moves need to stabilize beyond the $1,700 to convince short-term gold buyers. Following that, the weekly high of around $1,735 and the 200-SMA near $1,746 could be considered as the final defenses for the bears. In a case where the bullion prices cross the $1,746 hurdle, a run-up towards the late August swing high around $1,765 and then to the $1,800 threshold can’t be ruled. However, the previous monthly top surrounding $1,808 might allow the XAUUSD bull a break afterward.

To sum up, gold is likely to remain bearish ahead of the next week’s Fed meeting even if the downside appears limited.

Join us on FB and Twitter to stay updated on the latest market events.