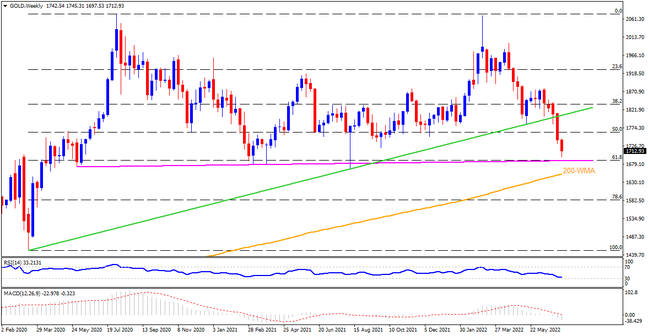

Gold braces for the fifth consecutive weekly fall at the yearly low. However, oversold RSI challenges the bears as they approach the $1,690 support confluence, comprising 61.8% Fibonacci retracement of March-August 2020 upside and an ascending trend line from May 2020. If the precious metal posts the weekly close below $1,690, it becomes vulnerable to testing the 200-week moving average (WMA) near $1,650. It’s worth noting that the $1,650 level is the last defense for the bullion buyers and a break of which will give rein to sellers.

Alternatively, the corrective pullback may aim for September 2021 low surrounding $1,721 before eying the 50% Fibonacci retracement level near $1,765. In a case where gold prices manage to stay beyond $1,765, the $1,800 threshold and the previous support line from early 2020, around $1,865, will regain the market’s attention.

Overall, the gold price is about the reach the bear’s home but multiple hurdles could trigger the corrective pullback.

Join us on FB and Twitter to stay updated on the latest market events.