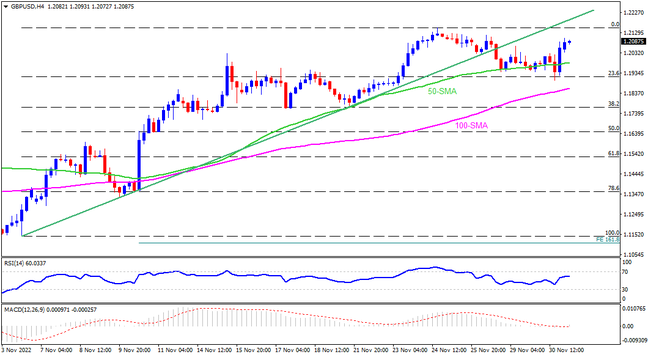

GBPUSD posted the biggest monthly gains since mid-2020 in November. However, the latest bullish trajectory appears doubtful as the pair stays beneath a one-month-old previous support line. That said, the 50-SMA restricts the pair’s immediate downside near 1.1985. Following that, the 100-SMA level surrounding 1.1860 could act as the last defense of the pair buyers before directing bears towards the 50% Fibonacci retracement level of November 04-24 upside, near 1.1650.

Meanwhile, the upside break of the stated support-turned-resistance line, around 1.2190. Although the RSI conditions may turn overbought and challenge further advances near 1.2190, a successful run-up won’t hesitate to aim for the August month’s high near 1.2295. It should be noted that the GBPUSD pair’s sustained trading beyond the 1.2300 round figure should give a free hand to bulls targeting the mid-2020 peak surrounding 1.2665, with 1.2405 likely acting as a buffer.

Join us on FB and Twitter to stay updated on the latest market events.