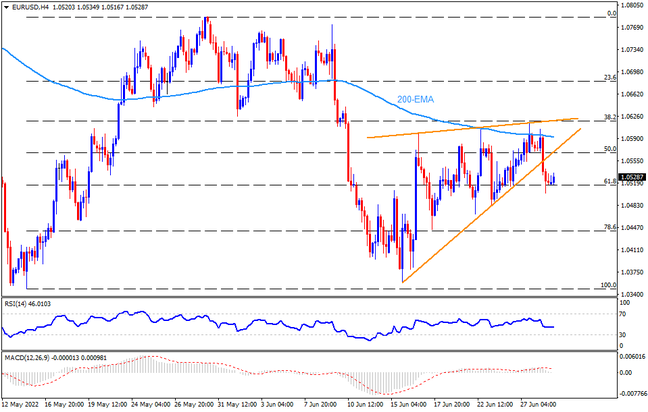

Not only a sustained trading below the 200-EMA but a clear downside break of the short-term ascending triangle also keeps EURUSD bears hopeful as traders await major central bankers’ debate at the ECB Forum. That said, 1.0460 appears the immediate support for the pair sellers to aim for ahead of looking at the yearly low surrounding 1.0350. During the fall, the 1.0400 round figure may offer an intermediate halt.

Meanwhile, a fortnight-old triangle’s support line, now resistance around 1.0560, restricts the short-term rebound of the EURUSD pair. Following that, the 200-EMA surrounding 1.0600 and the triangle’s upper line near 1.0620 could challenge the buyers before giving them control. Should the quote manage to remain firm past 1.0620, the upside momentum could then target the 1.0700 psychological magnet before the monthly peak of 1.0773.

Overall, EURUSD has already flashed bearish signals ahead of the week’s key event, which in turn makes it comfortable for sellers. However, the recession may probe policymakers from the ECB, BOE and the Fed, making it important to be cautious before taking big positions ahead of the event.

Join us on FB and Twitter to stay updated on the latest market events.