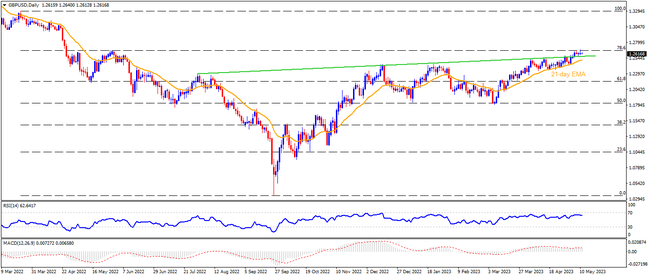

After taking out the 1.2580 key resistance, GBPUSD bulls jostle with the 78.6% Fibonacci retracement of its March-September 2022 downturn, around 1.2685. That said, the RSI (14) grinds near the overbought territory and the MACD signals are sluggish too, which in turn suggests that the buyers are running out of steam on the Bank of England (BoE) inspired “Super Thursday”. Hence, the Cable buyers need a strong boost from the “Old Lady”, as the BoE is often termed informally, to cross the aforementioned Fibonacci resistance. Following that, a run-up towards the April 2022 low of near 1.2980 and the 1.3000 round figure could act as the final checks for the upside momentum targeting the late March 2022 peak of around 1.3300.

On the contrary, a daily closing below the resistance-turned-support of around 1.2580, comprising an upward-sloping trend line from August 2022, could push back the intraday buyers. Even so, the 21-day EMA level of near 1.2510 may act as an additional downside filter before pushing the GBPUSD towards the previous monthly bottom surrounding 1.2275. It’s worth noting that the 61.8% and 50.0% Fibonacci retracement levels, close to 1.2170 and 1.1820 in that order, are the final defenses of the Cable pair buyers.

Overall, GBPUSD bulls occupy the driver’s seat on the key day but the upside room appears limited.

Join us on FB and Telegram to stay updated on the latest market events.