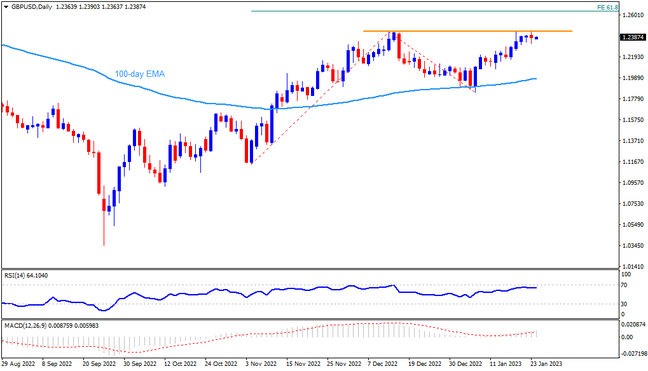

GBPUSD regains upside momentum, after a soft start to the week, as the Cable traders await the UK PMIs for January. It’s worth noting that the bullish MACD signals favor the latest upside but the RSI is nearly overbought, which in turn highlights the six-week-old horizontal resistance area surrounding 1.2450. Should the firmer British activity data allow the quote to cross the 1.2450 hurdle, the 61.8% Fibonacci Expansion (FE) of its November 2022 to January 2023 moves, near 1.2650, will be in focus. It’s worth noting that the May 2022 peak surrounding 1.2660 could challenge the pair buyers afterward.

Alternatively, the 1.2300 and the 1.2200 round figures could entertain the GBPUSD sellers during the pair’s pullback. However, the 1.2000 psychological magnet can restrict the Cable pair’s further downside. In a case where the quote remains weak past 1.2000, the 100-EMA level surrounding 1.1980 and the monthly low of 1.1840 will gain the market’s attention as the last defense of the pair buyers.

Overall, GBPUSD remains on the buyer’s radar ahead of the key UK data but the upside room appears limited.

Join us on FB and Twitter to stay updated on the latest market events.