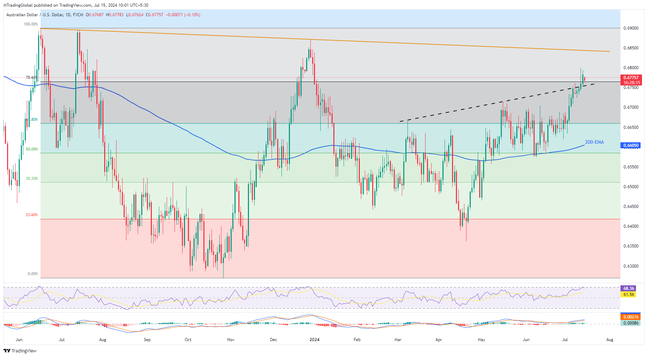

AUDUSD prints mild losses while snapping a four-day winning streak and paring the previous gains from a five-week uptrend after China reported downbeat Gross Domestic Product (GDP), Industrial Production, and Retail Sales early Monday. Even so, the Aussie pair defends last week’s upside break of a four-month-old ascending resistance line, now immediate support at 0.6750. The RSI (14) line’s retreat from overbought territory suggests the quote’s additional weakness, but the bullish MACD signals can join the trend line breakout to keep buyers hopeful past 0.6750. It’s worth noting, however, that the pair’s daily closing beneath 0.6750 will direct bears toward May’s peak of 0.6714. Following that, a 61.8% Fibonacci retracement of the June-October downside, near 0.6660, will precede the 200-day Exponential Moving Average (EMA) level of 0.6605 to act as the final defense of the buyers.

On the contrary, the AUDUSD buyers keep the reins beyond 0.6750 and can aim for the 0.6800 threshold for the short term. However, a downward-sloping resistance line from June 2023, close to 0.6850, quickly followed by the late 2023 high of 0.6870, appears tough nuts to crack for the bulls. In a case where the Aussie pair remains firmer past 0.6870, the odds of witnessing a run-up beyond the mid-2023 peak of 0.6900 will be certain, which in turn highlights the 0.7000 psychological magnet for the bulls.

Overall, AUDUSD buyers can ignore the latest retreat unless the quote stays beyond 0.6750.

Join us on FB and Telegram to stay updated on the latest market events.