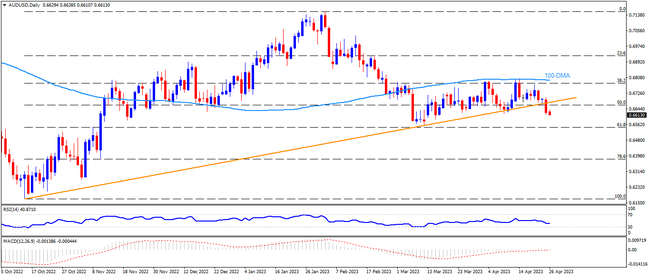

AUDUSD stays below the key support line stretched from the last October, after multiple rejections from the 100-DMA hurdle, as traders analyze Australian inflation data on Wednesday. With a clear break of important previous support joining downbeat RSI and bearish MACD signals, the Aussie pair has a further downside to track. The same highlights the 61.8% Fibonacci retracement of the pair’s October 2022 to February 2023 upside, near 0.6545, as immediate support to watch. Following that, the late October swing high near 0.6520 and the 78.6% Fibonacci retracement surrounding 0.6380 could lure the Aussie bears.

Meanwhile, the AUDUSD rebound needs to remain successfully beyond the aforementioned previous support line from late 2022, close to 0.6685 at the latest, to push back the bearish bias. In a case where the Aussie pair rises past 0.6685, the 100-DMA level near 0.6800 could regain the market’s attention as a break of which will lure the bulls. Should the quote remains bearish past 0.6800, the December 2022 peak of around 0.6895 and the 0.6900 round figure could act as the last defense of the sellers.

Overall, AUDUSD finally slips into the bear’s radar and is likely to drop further unless the quote stays beyond 0.6800.

Join us on FB and Telegram to stay updated on the latest market events.